Alright, let's be real. "Safe haven" in DeFi? Give me a break. After that October crash everyone's still crying about, we're supposed to get excited about tokens that are only *down* like, 12%? That’s the big win? Color me unimpressed.

"Safer" DeFi? More Like "Less Screwed"

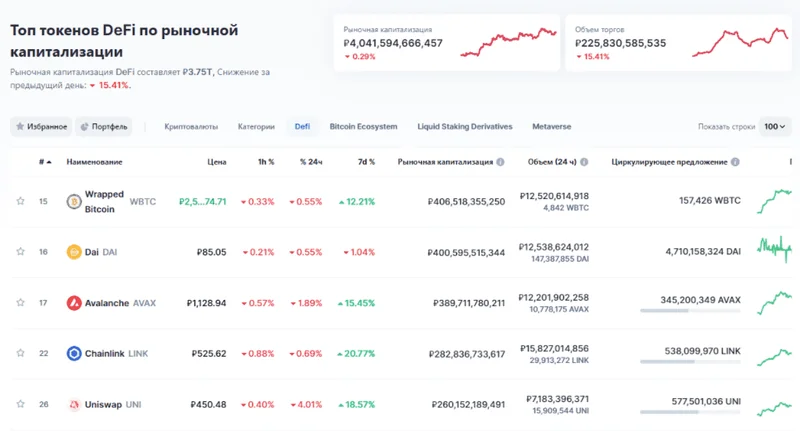

The "Winners" Circle of Losers So, FalconX is trying to spin this narrative that investors are flocking to "safer" DeFi names. Okay, sure. Safer like diving into a kiddie pool during a tsunami instead of the open ocean. We're talking about HYPE and CAKE, down 16% and 12% QTD respectively. These are the best performers? This is the financial revolution we were promised? DeFi Token Performance & Investor Trends Post-October Crash And the reasoning? Buybacks. Seriously? Companies buying their own stock to artificially inflate the price is now considered a sign of... stability? Sounds more like desperation to me. What happens when the buybacks stop? Poof. Then there's MORPHO and SYRUP, supposedly outperforming because they weren't as screwed by the Stream Finance collapse. Congrats, guys. You only got *slightly* less rekt. That’s what passes for a "fundamental catalyst" these days. I'm looking at this report from FalconX, and I'm asking myself, is this the best we got? Are we so beaten down that "didn't lose *as* much" is now a selling point?DeFi Sector Rotation: Musical Chairs on the Crypto Titanic

Sector Rotation: Rearranging the Deck Chairs on the Titanic Oh, and get this: "Certain DeFi subsectors have become more expensive, while some have cheapened." No freakin' way! You mean the market *changes*? Groundbreaking analysis, FalconX. Spot and perpetual DEXes are supposedly getting cheaper because their prices dropped faster than their activity. But wait, CRV, RUNE, and CAKE (again!) are posting *higher* fees? So which is it? Are DEXes dying or thriving? Or is it just a mixed bag of garbage like everything else in crypto? Lending and yield names are "steepening on a multiples basis" because their prices didn't fall as hard as their fees. KMNO's market cap is down 13%, but fees are down 34%! That doesn't sound like a ringing endorsement to me. Apparently, investors are "crowding" into lending because it's "stickier." Stickier like a leech, maybe. Are people really buying this? Are we really supposed to believe that shifting money from one failing DeFi protocol to another is some kind of genius move? It feels less like strategic allocation and more like musical chairs on the crypto Titanic. Hey, you know what's *really* stickier than lending? A 9-to-5 job. Maybe these geniuses should try that for a while.DeFi "Growth": Or, How to Polish a Turd

The "Growth" Mirage of 2026 So, this all supposedly "reflects where investors think the DeFi sector will see growth in 2026." Oh, I *love* predictions. Especially in crypto, where everyone's a freakin' Nostradamus. Apparently, investors expect "perps to continue to lead," and HYPE's "perps on anything" is the future. Perps on anything? Sounds like a casino to me. And the only crypto trading category seeing "record volumes lately are prediction markets." So, gambling is the future of finance? Makes sense, I guess. Lending is supposedly looking to "more fintech integrations to drive growth." AAVE's high-yield savings account and MORPHO's Coinbase integration are the examples? Seriously? That's the big innovation? Banks already do that, but banks at least have FDIC insurance. The whole thing feels like grasping at straws. It's like trying to build a skyscraper on a foundation of sand. They're pointing at "potential opportunities from dislocations," but all I see is a bunch of people desperately trying to salvage what's left after the bomb went off. So, What's the Actual Story? Look, let's be clear: DeFi is still a goddamn mess. This whole "safe haven" narrative is just PR spin to try and lure in more suckers. Are there *some* glimmers of hope? Maybe. But are any of these tokens actually "safe"? Hell no. It's all still a gamble, and anyone who tells you otherwise is trying to sell you something. And offcourse, I'm just some random dude on the internet. So what do I know?