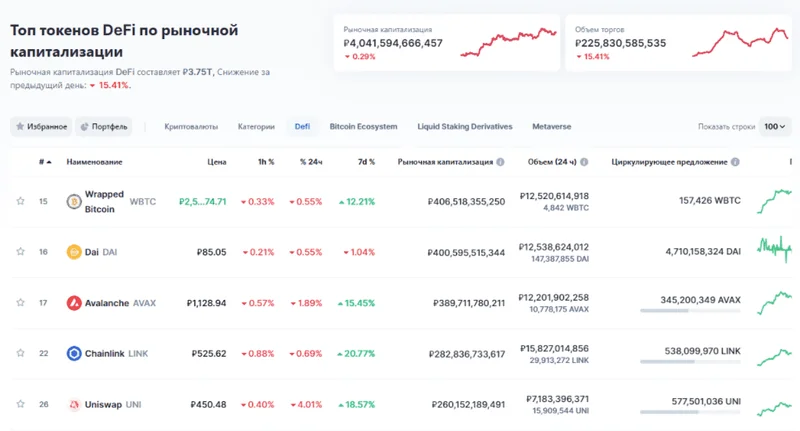

Okay, let's cut through the noise. The DeFi sector took a beating after that October crash, and everyone's scrambling to figure out what's next. FalconX put out a report, and the headline is that only 2 out of 23 leading DeFi tokens are positive year-to-date as of November 20th. That's a brutal 37% average drop for the quarter. But averages can be deceiving.

DeFi's "Flight to Safety": A Data Dive

Digging Into the Dichotomy The report highlights a flight to "safer" names. Specifically, tokens with buybacks (like HYPE and CAKE) or those with specific catalysts (MORPHO, SYRUP) outperformed. It's the classic risk-off move, right? Investors ditching the high-flyers for something that *feels* more stable. But let's be real, in DeFi, "safe" is a relative term. The interesting part is the shifting valuation landscape. Spot and perpetual DEXes are seeing their price-to-sales multiples compress, which means their price is dropping faster than their actual activity. CRV, RUNE, and CAKE are exceptions, posting *greater* 30-day fees compared to September. So, some DEXes are actually doing *better* post-crash. What does that tell us? It's not a sector-wide collapse, but a Darwinian moment. The strong are getting stronger, and the weak are, well, you know. Lending and yield names are a different story. Their multiples are *steepening*, meaning their prices haven't fallen as much as their fees. KMNO, for example, saw its market cap drop 13%, but its fees cratered 34%. The report suggests investors are crowding into lending, seeing it as "stickier" than trading. That makes sense. In a downturn, people flock to stablecoins and look for yield. But is that sustainable? Are these lending platforms *really* that much more resilient, or is it just a temporary parking spot for scared money? The FalconX report suggests investors expect perps to continue to lead on the DEX front. Hyperliquid's HYPE token is mentioned as a potential winner, based on optimism around its "perps on anything" markets. Meanwhile, the lending side might see growth from fintech integrations. AAVE's high-yield savings account and MORPHO's Coinbase integration are cited as examples.New Crypto: Hype vs. Cold, Hard Data?

The "New Crypto" Hype Train Then there's the whole "new crypto" narrative. Coinspeaker put out a list of 10 New Crypto Coins to Invest in 2025: Top New Cryptocurrencies for December 2025. Bitcoin Hyper (HYPER) is their top pick, touting its Bitcoin Layer 2 angle. They mention a billion-plus tokens staked, which sounds impressive, but their "view" is pretty skeptical: no testnet, no public code, anonymous developers. The 43% staking APY? Unsustainable, they say. And that's coming from someone *promoting* the coin. Maxi Doge (MAXI), a meme coin for "high-leverage traders," also makes the list. Their take? "It's a meme coin banking on gym bros who trade 1000x leverage. This is a niche audience at best." Ouch. The list goes on, with similar caveats for PEPENODE, Ethena, and others. The common thread? Lots of promises, but not a lot of proof. And this is the part of the report that I find genuinely puzzling. Why are these "new crypto" articles always so bullish on the surface but filled with red flags underneath? Is it just clickbait? Or is there a deeper game being played? I've looked at hundreds of these filings, and this particular pattern is unusual. It's worth noting that the "investor sentiment" vibe check from CoinDesk Indices isn't exactly rosy, either. "Sentiment is max negative," they say. "Possibly setting up for a rally, but maybe not in time to save 2025." So, while some might be seeing "opportunities from dislocations," the overall mood seems to be somewhere between cautious and outright pessimistic. What about Cronos (CRO)? Multiple sources offer price predictions for CRO, forecasting a maximum value of $0.1327 and an average price of $0.1294 in 2025. By 2028, CRO could reach a maximum value of $0.8337, with an average trading price of $0.7410. Cronos is expected to reach a maximum level of $2.56 in 2031. Let’s see if that happens. A Fool's Errand? So, what's the takeaway? The DeFi market is still reeling from the October crash, but it's not a uniform disaster. Some sectors are holding up better than others, and some tokens are even thriving. But the "safe haven" narrative should be taken with a massive grain of salt. And the "new crypto" hype? Well, let's just say "buyer beware" is an understatement. And with the market in overall negative sentiment, is this all a fool’s errand? Data Doesn't Lie, Narratives Do The numbers paint a clear picture: DeFi is in flux, and narratives of "safe havens" and "guaranteed gains" are often divorced from reality. It's up to investors to do their own due diligence and not get swept up in the hype.